We utilize this model on growth assets with moderate risk and stabilized assets with low risk, aiming to provide investors with the highest potential return while minimizing the potential for losses.

In our search for suitable properties, we target markets comprising a minimum of 20,000+ residents to guarantee sustained economic expansion for the benefit of our investors.

We target properties that have no less than 35,000+ rentable square feet for self storage and 40+ doors for multi-family, leaving plenty of room for new tenants.

We target properties in strong markets with high visibility, ensuring the future is bright for all of our investors.

We continue seeing a demand for apartment living along with self-storage utilization. These are great asset classes that are in demand and resistant to recessionary markets.

We identify and target underperforming properties in these markets in order to apply the BRRR Method and get maximum cash flow potential for our investors.

We love working directly with owners. 70% of self-storage facilities are owned by mom and pop operators which provides enormous acquisition potential and exit opportunities for our investors for this asset class.

Rassam Capital is a value add private equity real estate firm specializing in the acquisition, development, and management of self-storage and multi-family properties. Rassam Capital drives shareholder values through its multifaceted strategies and strong performance.

Connect with our investor relations team to learn more about our current offerings,

proven track record, and investment strategy.

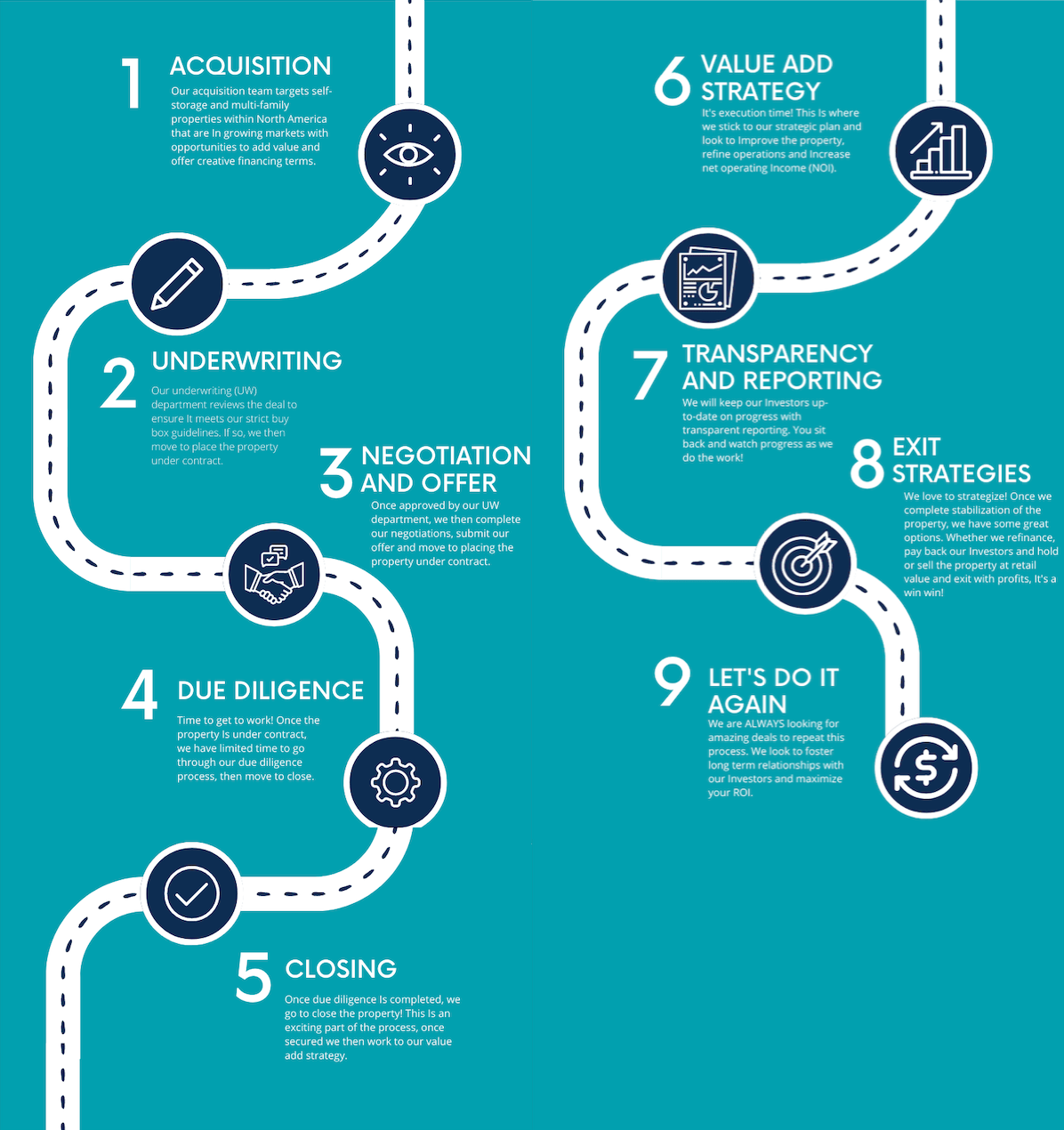

Rassam Capital offers you a fully hands-off investing experience. We manage every aspect step by step, ensuring your investment is entirely passive. From identifying lucrative opportunities to conducting comprehensive underwriting, we take care of it all. Rest assured, we meticulously analyze each deal to ensure it delivers secure and favorable returns.

Copyright © 2023 RassamCapital.com All Rights Reserved